In this article, we’re focusing on the US business legalities of selling on marketplaces like Amazon. In particular, we’ll be providing information to help you decide if you need an LLC or a business license for Amazon FBA.

Amazon marketplace has 300 million active users, and it’s a great platform to start your eCommerce business. However, even under the FBA model, where Amazon takes care of a lot of the heavy lifting, there is still some unavoidable paperwork and legalities that need to be considered.

ABOUT THE AUTHOR

Mushma Shami BSC (Hons) Applied Accounting

Mushma is a Hustle Life guest writer with an honours degree in Applied Accounting and has been certified by the Association of Chartered Certified Accountants (ACCA).

She enjoys writing about and sharing her thoughts on best practice for digital businesses.

We look forward to more great articles from Mushma.

Let’s put this in simple terms. Just like you would need a driver’s license in order to legally drive on public roads, the same kind of principle applies to a business license.

A business license or a business permit allows you to operate and run certain types of business legally. Your local, state, or federal government can issue different types of business permits.

Firstly, let’s clear up a common misconception. You’re NOT usually required to have a business license for your Amazon FBA business. Most products sold on Amazon and other similar marketplaces are low-risk consumer products with simple regulatory controls.

For example, a business license wouldn’t be needed if you sell coffee cups or T-shirts. But one may be needed if you’re selling cosmetics or products making a health claim or benefit.

The rules and regulations can vary from State to State, so if you’re not sure, then it’s better to check with your local government or federal agency.

Note also that if you’re selling in another country, rules may also be different. If you are selling on Amazon in the UK then you should be reading Do I Need a Business License to Sell on Amazon UK?

If you plan to sell a product or provide a service that falls under a business license scenario, you may be thinking: “What business license do I need to sell on Amazon?”. To answer your question, it’s essential to know the main types of business licenses in the US.

If your business activity falls into one of these categories, you must contact your issuing federal agency and get a license to avoid any legal issues down the road. Types of business affected are:

More information can be found at the U.S. Small Business Administration.

Individual States tend to oversee a broader range of activities than the federal government. So even if your business doesn’t meet federal rules, it may fall under a state, county, or city permit requirement. Some of the business activities that may require a license under local rules are:

As every city has different license and permit requirements, you should confirm this by searching for your business license in your particular City or State and visiting the local government websites. Search on Google like this:

<Your city> + Business License

<Your state> + Business License

Do your research carefully and document what you learn to protect yourself. If you are amongst the small percentage of Amazon sellers requiring a license, do the right thing. Remember, there can be hefty fines for anyone trading without the necessary permits.

A Limited Liability Company (LLC), is a different thing and doesn’t relate to business permits and licenses. An LLC is a legal entity that you can form to own and operate a business.

LLCs are common amongst eCommerce entrepreneurs and a typical structure to consider if you want to get serious about making money online. Certain benefits come with an LLC:

The short and direct answer to the question, “do you need an LLC to sell on Amazon FBA?” is No, you don’t. To explain everything related to this topic, we’ve answered some common questions below:

You don’t have any obligation to start your Amazon FBA Business as an LLC from the get-go. Instead, many sellers choose to operate as a sole proprietor to keep things simple until they can prove that their business will make money.

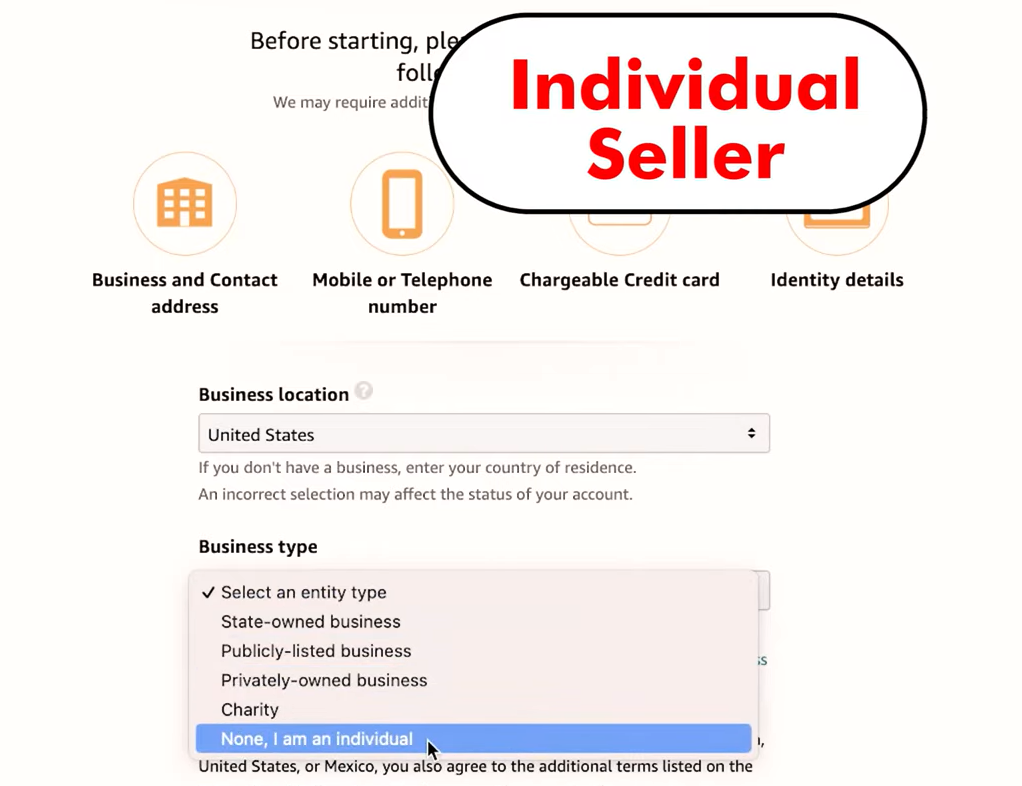

One of the first steps when setting up your Amazon seller account asks for your business type, and by selecting the “None, I am an Individual” option, you aren’t required to provide any business license.

As soon as you start getting an increased number of sales on your Amazon account and want to expand your business, it’s ideal to switch to an LLC. Why?

With your customer base significantly growing, your risks will also increase. LLCs offer certain protections by separating you from your business operations. In addition, if you operate as a business, you will look more credible in the eyes of your suppliers and potential customers.

You can easily update your legal entity on your Amazon Seller Central in the following steps:

You may have to get a business license and a sales tax permit if you are about to start selling wholesale products on your Amazon account.

To purchase products in bulk at a lower price and sell them on Amazon for a profit, you need to legitimize your business so suppliers will easily work with you. Showing these documents will assure the distributors that you’re a legitimate FBA seller.

Whether you want to operate your business as a retail arbitrage seller or wholesaler, it’s best to consult with a professional accountant or lawyer to confirm the specific requirements in your State.

If you have made a decision to register your online business in the US, follow these steps:

Business structure, also known as a business entity, determines how your business will be operated, managed, legally protected, and taxed. Some of the common business structures used by FBA sellers are:

Sole Proprietorship – Usually, small businesses in the US start as sole proprietorships, and a business owner has unlimited personal liability, so there’s really no legal protection.

DBA - DBA (Doing Business As) where you register your business under a trading name (not your own name). This offers some level of privacy but doesn’t offer any kind of protection. You and your business are still considered the same entity. The main benefit of a DBA is that it establishes a more professional look to your suppliers and customers.

LLC – You can hire employees for your business, and liability is limited to the company only. It’s an ideal way to keep your living and business expenses completely separate.

You can register your business name with four methods: entity name, trademark, DBA, domain name. However, the most common one is DBA for online businesses.

You need to check with your local government agency for particular requirements to register with a DBA.

As you’ll be selling products on Amazon, you will need to collect sales tax from customers and remit it to your government. In some cases, Amazon may automatically collect sales tax.

However, where you need to collect sales tax yourself, you need to have a seller’s permit or a sales tax ID. To remit sales tax, you should log in to your respective State's “department of revenue” website.

To help manage federal taxes, you need a federal tax ID, also called Employer Identification Number (EIN), which is a must for LLCs. This way, you can also open your business bank account and help the IRS track your tax-related activities.

You can visit the IRS website and apply online to get your EIN without any hassle.

You’re not required to get an EIN as a sole proprietor. Your social security number will suffice for this matter.

No, not initially. Amazon only requires product liability insurance after you’re making sales over $10,000 per month.

Even so, if your Amazon FBA business is registered as an LLC, being insured may be a sensible option (depending on your risk level) to provide your business with an extra layer of protection.

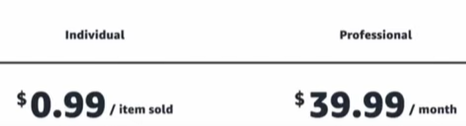

If you sell less than 40 units a month, an individual selling plan will be right for you. However, you can still choose a professional seller account as you will get a lot of perks like advertisements, advanced selling tools, etc.

OUR HUSTLE LIFE TIP: When starting out, you can set up as an individual seller (instead of a professional seller). Once you’re selling more than 40 units per month, then you can switch your account to a professional account to take advantage of the inclusive pro plan pricing.

While there are a few legalities to consider, most FBA sellers can operate under a simple LLC structure, and most sellers don’t require any kind of permit or license.

There are also some branding and trademark licenses that might benefit you, and these offer additional protections to your business and products.

The important thing is to do your homework. This is normally enough for some sellers just wanting a simple side hustle. But, if you’re still concerned, there are some specialist organizations like Legal Zoom that provide advice and other services to get you on the right track.

Better yet, consider taking an Amazon FBA course. There are several courses that offer detailed step-by-step instruction, guidance, and coaching to get you set up and building your FBA business. The benefit is that you follow in the footsteps of eCommerce and FBA power sellers and get genuine, relevant information that you can use to create an FBA business.

In this post, we’ve addressed some of the common questions around ‘Do I Need a Business License to Sell on Amazon?’. We’ve also discussed the benefits of having an LLC for selling on Amazon. We hope this has been helpful and clarified some of the important first steps in setting up as an Amazon FBA seller.

DBA (Doing Business As) allows you to register your business under another name other than your own. It’s not mandatory, but it can enhance your brand presence and give your online business a professional look. It can also help you open a business bank account.

As a sole proprietor or an LLC, you don’t need to secure a seller's permit to start selling on Amazon as long as your products don’t need Federal Regulations.

Some products under Federal Regulations are alcoholic beverages, firearms, and ammunition. For the complete list, check out the SBA website.

If you plan on being an Amazon seller as a side hustle, you can stick to a sole proprietorship; there isn’t a real need to be an LLC.

However, if you’re determined to grow your business in Amazon, it is wise to be an LLC to give you a sense of security because not all customers are the same. One customer may sue you because they feel that you ripped them off.

Another customer may try to scam you. Both scenarios can potentially bring down your business.

Being an LLC separates your business assets from your personal assets, so the latter is protected.

Selling on Amazon doesn’t require you to be a registered business to sell on their platform. However, please be advised that your state or town may require you to register your business, and it’s wiser to abide by the law to avoid problems in the future.

No, you don’t need a business license to sell on the internet as long as your products are not under federal regulation.

Yes, you can open a seller account on Amazon as an individual.

No, but you need to secure one for business tax filing. Because every transaction made between you and a buyer means you must collect sales tax from the state where the online business is transacted.

No, SSN is used as your tax identification number when filing your business tax as a sole proprietor.

You should consider registering a trademark to:

No, you don’t need a business license to sell on Amazon Canada. However, taxes will be still involved and the Canadian government will require you to pay a Seller’s Tax. It is a tax for goods or products sold online or not.

No. What you need to get is an EORI number to send your products in the UK. EORI is your company or product’s unique identifying number.

If you don’t have an EORI number, the UK customs will require you to get one before it leaves customs. You will get your EORI number by applying for VAT through the HM Revenue & Customs in the UK.

It is best to secure an EORI number first because the longer your product sits on HMRC, penalties will add up and you need to pay it before they free your product.

Disclaimer: Information printed on this site is general and not a one size fits all. The details of your own situation should be carefully considered. Do your own research from reputable sources and where necessary seek advice from a qualified individual about your specific circumstances. We encourage you to make your decisions based on due diligence.

We're An Affiliate - We are reluctant to allow advertising on this blog, which we believe will spoil the user experience. Instead (so that we can continue sharing our knowledge and expanding our content), we have decided to include affiliate links for the products that we use and/or rate highly.