Cerebro is one of the most powerful Helium 10 tools. AND it is almost certainly the MOST advanced keyword research tool available for Amazon sellers.

I use Helium 10 for several reasons, but competitor research is an important (and ongoing activity), especially for my pet niche products. Cerebro is my go-to tool for taking care of this job!

In this Helium 10 Cerebro tutorial, I will:

For eCommerce and online retail, finding the right keywords can be the key to unlocking your product's success.

In simple terms, understanding the language that customers use to search for products on platforms like Amazon is crucial for advertising, optimizing product listings, and ultimately, driving sales. This is known as Amazon search engine optimization.

At a basic level, any online seller can try and guess the keywords that customers are using. If you know your customers very well and you have low competition, then this tactic could work. But if you have a competitive marketplace with aggressive sellers (like Amazon) then guessing keywords is not a winning formula for success.

The solution to this problem is to use software like Cerebro. A powerful tool (part of the Helium 10 Amazon seller software suite) that you can use to uncover competitor keywords to rank your Amazon products on page one of the results.

Every day millions of people are shopping on Amazon. Pretty much everyone going to Amazon uses the search function. What customers type into the search box are known as keywords.

This is how Amazon knows what a customer wants to buy.

It’s important to understand that Amazon is a highly competitive marketplace, and its main purpose is to connect buyers and sellers. Amazon wants to give customers a solution to their problem (or need) as fast as possible.

So, with that in mind, it’s easy to see why Amazon will show products with the matching searched keywords in their listing.

When you use those relevant and matching keywords in your listings it is known as Amazon search engine optimization.

Think about your own shopping habits. How often do you scroll past the first few products? For most people, this is not so often.

Every seller wants to be on page one of the Amazon results page. Products on page one make more sales. It’s that simple!

That’s also my goal. Using a reverse ASIN keyword tool, I want to find winning competitor keywords that I can also use to get my products on page one of the Amazon results page.

So now that you understand the goal, we can get into the Helium 10 Cerebro tutorial and my top 8 Cerebro keyword research strategies.

The first thing I normally do is to find a competing product that is performing better than my own product. My aim here is to work out WHY!

Here are my workflow steps for direct Amazon competitor analysis of keywords:

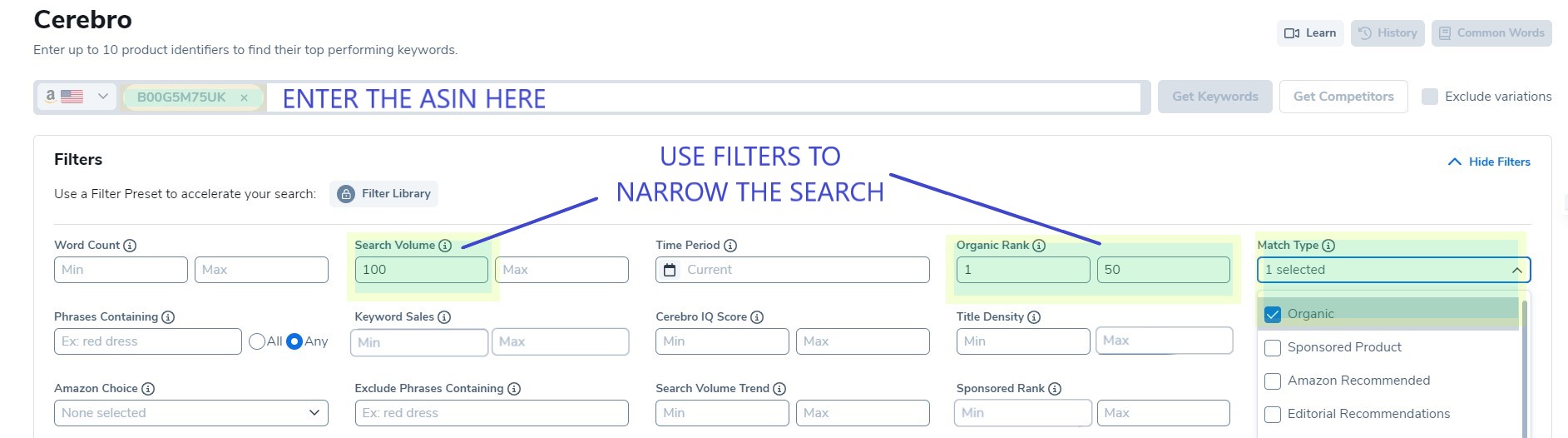

Using the following basic filter criteria, I can look at a competitor’s product and do an ASIN keyword search to start to understand the keywords that are helping that product rank.

I do this so that I can learn what my competitors are doing. Why are their products getting listed in the Amazon search results above my own? Why are they selling more?

I want to focus on keywords that rank well and have high search volumes on Amazon. See in the example below how I have selected filters for 1 to 50 organic ranking and keyword volume (Amazon monthly search volume) with a minimum of 100 (or more depending on the product and marketplace. See FAQs for more on this).

Using the Match Type filter, I select ‘Organic’. This will remove results for paid traffic.

I can view the keyword list inside of Cerebro and do my analysis (see the section below ‘Finding High-Value Keywords’ to understand more). In this keyword list, I can find the top keywords on Amazon for my competitor's products.

I can also download and extract the list into Excel. This is useful for further analysis.

Again, Cerebro will give me a list of my own product keywords that I can extract into excel. Even though I might know what my keywords are, this listing will give me more insights into which keywords are matching with the top search terms on Amazon. I can start to understand if I need to modify my Amazon backend keywords to optimize my listing.

Using the two extracted keyword lists (from steps 4 & 5 above) I can do some analysis and find keywords that my competitors are using that I am not! I can also see the most searched keywords on Amazon for a specific product.

At this stage of my research, I’m looking for gaps in my keywords. In the following strategies, I’ll show you how to start being more selective and prioritizing keywords.

Even if keywords are relevant to a product a winning keyword also needs to have a high search volume. Valuable keywords are the ones with higher search volume. It’s a super important strategy so that I can prioritize my keywords.

Here are my workflow steps for finding winning keywords:

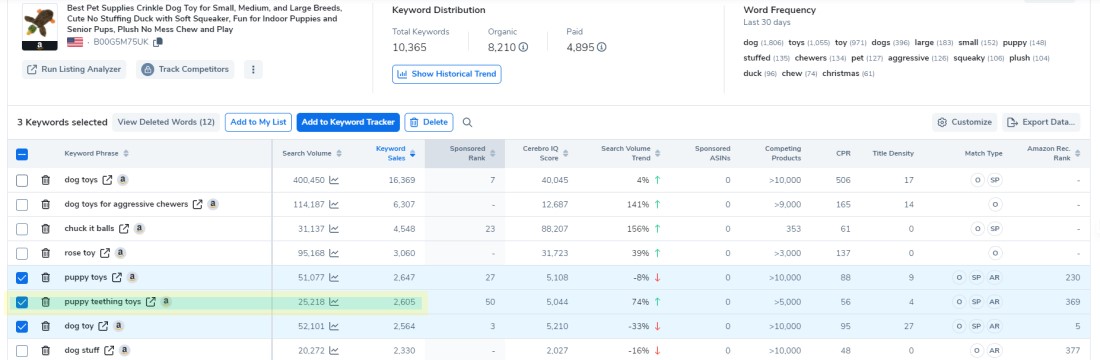

Inside Cerebro, there is a column labeled ‘Search Volume’. High Amazon search volume is a good sign that Amazon customers have a need or want for that product. These are the keywords I’m most interested in prioritizing in my listings.

Just because a keyword has a high search volume doesn’t mean it converts to sales.

The ‘Keyword Sales’ column uses Amazon data to help estimate the number of sales for a keyword. This is a great metric to help decide just how powerful a keyword is at generating more sales!

See in the screenshot below, I’ve selected two example keywords that are both high volume, but ‘puppy teething toys’ makes considerably more sales. Actually, more than double! Both are valuable keywords because of the volume. But I would prioritize ‘puppy teething toys’ in my listing.

Some of the high-volume keywords are also seasonal, so I want to understand this and see if seasonal variations will affect my sales.

Next to the ‘Search Volume’ number, there is a small graph icon. If you click on this Cerebro will show the Amazon search volume history.

The search volume history graph is an easy way to see seasonal Amazon trending keywords. In the example below there is a clear spike in search volume during December each year!

If I were to run a keyword search, then I could make a false assumption about sales volume. I need to be careful that spikes like this don’t skew my research.

Some keywords also trend and become more popular or ‘fashionable’.

The ‘Search Volume Trend’ column shows the growth or decline in popularity. Normally I want to look at the keywords that are growing in popularity. These are Amazon trending keywords.

I also need to keep an eye on keywords that were previously popular but are losing their significance with my audience.

If you want to do advertising, then start by analyzing your competitor's Amazon PPC keywords and campaigns.

I use successful PPC campaigns and replicate their formula. This is a smart way to avoid throwing money away on Amazon PPC keywords that don’t convert.

Here are my workflow steps for analyzing competitor PPC campaigns for high-value keywords:

I want to focus on keywords that have a good, sponsored ranking, so I narrow the ‘Sponsored Ranking’ filter from 1 to 10 AND select only ‘Sponsored Product’ under the Match Type filter.

When I select ‘Apply Filters’ I can start to understand my competitors’ Amazon PPC keywords.

Another important metric is to look at the number of ASINs using a specific keyword in their sponsored ads. See column ‘Sponsored ASIN’.

A lower number here indicates less competition. For PPC campaigns, I’m ideally looking for a keyword with reasonable volume and low competition. This is the sweet spot!

Long tail keywords typically have a high buyer intent. The reason is that someone typing a long tail keyword is more likely to have a specific problem or need that they want to solve.

These long tail keywords are often lower volume BUT are historically higher converting.

I want to find long-tail keywords that contain words of high frequency. To do this I can look at the ‘Word Frequency’ results. I take note of the high-volume words that are more frequently appearing as keywords.

Using the Word Count filter, I enter 3 as a minimum and in ‘Phrase Containing’, I include one of the words from the ‘Word Frequency’ list.

I can also exclude words and phrases if I want to narrow the search further. For example, I sometimes want to avoid seasonal keywords or avoid keywords that are forbidden by Amazon or a brand name.

Like with other strategies when I’m analyzing the results, I’m always looking for higher volume keywords with good sales/conversions and low competition.

In the screenshot below you can see a good example of buyer intent with a long tail keyword compared to a shorter keyword. ‘Puppy teething toys’ get around double the number of conversions compared to other similarly searched keywords.

You can’t just make a product listing and instantly appear on page one of the search results. This is especially true if you only use high volume, high competing keywords. It can take time (and several sales) for Amazon to recognize your listing as being relevant.

But there are ways to try and beat the system. Here is my process:

Title Density is the number of products being listed using a particular keyword in the title. In this strategy I am looking for the keywords with a reasonable Amazon search volume AND low Title Density (e.g., under 10) are the keywords I can use in my product title. Using these keywords in my title will help me rank on page one quickly.

I can even use the Title Density filter to help speed up the process and narrow down my search.

This is the number of sales I need to make from that specific keyword before Amazon’s algorithm will rank me on page one for that keyword. If this number is high, it means it’s competitive and I know that it’s going to take time to rank for that keyword.

Amazon indexing is where your product is linked to a keyword in the Amazon database. Giving you the potential to show up in the search results.

The trick to this strategy is to find keywords that not many products are indexed for.

In the ‘Competing Products’ filter, I enter a maximum value of 200.

I’m looking for results with a good search volume on Amazon but with fewer competing products.

This is probably THE most important strategy. And, luckily for me, Helium 10 Cerebro is the only tool available that has an Amazon Recommended Rank for each keyword!

Your keyword research may not always detect the keywords that the Amazon Algorithm thinks are most relevant for a product!

If you’re not including the Amazon Algorithm keywords, then you’ll struggle to get your product to rank or get impressions for your Amazon PPC keywords.

Here are my process steps for finding these keywords:

A recommended rank of 1 is the keyword with the most relevance. A high Amazon recommended rank is considered less relevant. If there isn’t a number at all in this column, then Amazon definitely considers this keyword irrelevant!

I can use this report to add low ARR keywords to my listing. See in the screenshot above I’ve selected two keywords with a low Amazon Recommended Rank.

Conversely, If I believe that my most relevant keywords have a high ARR, then I know I have to improve my listing and my sales conversions for that keyword. This will help the Amazon algorithm understand my product better and then rank me better for my most relevant keywords.

Buyers are more inclined to purchase products with the Amazon Choice (Overall Pick) Badge.

It only makes sense for us to identify those sellers and products that have this badge.

Follow the process steps below to find the keywords associated with an Amazon Choice Badge:

Use this filter to select ‘Analyzed Product’.

This will show all the keywords for which this product has had the Amazon Choice Badge.

Using this data, you can see if there are keyword gaps that your competitors are not getting Amazon choice for. These are the relevant keywords you can target.

If your main competitors are winning Amazon Choice for all the important and relevant keywords, then you know you have some tough competition!

Doing keyword research is something that takes time, and it isn’t an exact science. It can get overwhelming and confusing. Here are my tips for getting the most out of your Cerebro search results:

For each strategy, you can extract the results into a spreadsheet (excel) format. In Excel, you can sort and organize your keywords. I like to use color coding to highlight my important keywords.

You can also use lists inside of Cerebro and sort and organize your keywords (no need to use Excel). Whatever you do, you have to use some sort of organized process.

Keep keyword relevancy top of mind. Manually delete or exclude any keywords that are not relevant. See how I’ve excluded strange keywords from my list in the screenshot below. These have high search volume, but I’ll get low conversions using these keywords!

When you have a final list use Helium 10 Frankenstein to manage your keywords for your listings.

My main reason for using Cerebro is because it is the premium keyword research tool for Amazon and Walmart sellers. There is currently no better or more accurate Amazon keyword research tool. It’s that simple.

But I also have some other reasons, such as:

The reverse ASIN feature makes it easy for me to use competitor data to improve my own product listings. I especially like that I can paste up to 10 ASINs into the one search.

The tool can be used for multiple markets across Amazon globally and also Walmart.com.

I like that Cerebro is easy to use and that Helium 10 provides thorough step-by-step Pro training.

I can export results straight into Helium 10 Frankenstein or Excel.

Even though the keyword results can be overwhelming, I can narrow down my searches using convenient filters.

I haven’t talked about Cerebro One-Click Filters in this article, but this feature is a super easy way to get Top Keywords and Opportunity Keywords using preset filters!

I also like that you can modify your dashboard and hide irrelevant columns and data to get a cleaner result.

I think the main limitation is that the data is typically only from the last 30 days. Normally this isn’t a huge problem. But let’s say I want to look for Easter keywords, but I’m doing the search in October. With Cerebro, the only data I can get is the historical search volume chart. No other keyword data. That’s an annoying problem!

The other issue is that Cerebro has a limited number of uses on the Helium 10 Starter Plan. If you have a few products and you want to optimize your listings, then this could become restrictive, meaning you have to go up a plan.

The Helium 10 Cerebro Price is included in the Helium 10 suite. There are three pricing tiers depending on the tools you need and the amount you want to pay for the monthly subscription.

In conclusion, effective Amazon keyword research is the backbone of a successful eCommerce business.

In this article, I have given you my 8 strategies using Helium 10 Cerebro as an Amazon keyword research tool. Using these strategies, you can do competitor research to find winning keywords to help rank your products on page one. If implemented, all my 8 strategies have the potential to help you increase your Amazon product sales.

Remember to leverage Helium 10's Cerebro tool, utilize filters for valuable insights, and stay vigilant with the latest Amazon trending keywords.

Not using Helium 10 or Cerebro yet? Then take the plunge and start using this powerful tool to become a better and more successful Amazon seller. Start a free trial today!

At Hustle Life we love bringing you well-researched content to help you online side hustle grow into a thriving business. So that we continue to create great content without opening the site to annoying advertising, we accept affiliate payments. Thank you for using our Helium 10 affiliate links.

If you enjoy our content, please remember to like, and follow us on Facebook.

Jessica Clark has a passion for all things eCommerce. She’s always learning and adapting to find efficiencies and to stay competitive in a fast-paced sector.

Depending on the marketplace and the product competition use a minimum of 500 searches in the USA. But in other smaller markets, 100 may be a better number. Test out the filters and keep adjusting the numbers if you get too few or too many keywords!

Yes, Cerebro Helium 10 can be used in many countries and regions. If you are an Amazon seller in the USA, Canada, Mexico, Germany, Spain, Italy, France, UK, India, Netherlands, Australia, Japan United Arab Emirates, and even the Walmart.com USA marketplace.

Cerebro can be used for Walmart.com (USA) keyword research. If you are an Amazon seller that has expanded into Walmart.com then using Helium 10 across both marketplaces is a good solution.

However, if you are only on Walmart.com then you may want to look at WallySmarter, which is a more affordable tool with specific search algorithms for Walmart. It’s actually the best Helium 10 Cerebro alternative for Walmart.com sellers!

Helium 10’s Magnet and Cerebro are amongst the best Amazon keyword research tools available to Amazon and Walmart.com sellers.

How to find products to sell on Amazon? Magnet is the answer! This tool helps you to do broad keyword research to identify possible product or niche opportunities.

The Cerebro Helium 10 tool is a reverse ASIN lookup tool, enabling you to do competitor analysis on up to 10 ASINs at a time!

If you want access to a free Amazon reverse ASIN tool, then try the Helium 10 Chrome Extension. It’s a free download and gives you limited access to the Helium 10 tools.

We're An Affiliate - We are reluctant to allow advertising on this blog, which we believe will spoil the user experience. Instead (so that we can continue sharing our knowledge and expanding our content), we have decided to include affiliate links for the products that we use and/or rate highly.